Welcome to our first blog of the series “Workforce Housing Investing 101”. We aim to provide a foundation for people who want to learn more about the asset class and diversify their portfolio with this unique subsector within real estate.

First thing first, what is workforce housing?

“Workforce housing is defined as that in which families earning 60% to 100% of area median income (AMI) live.”

– CBRE

Workforce housing does not equal to low income housing, nor it is considered as affordable housing program runs by the government. It instead covers the demographics that are not eligible for government program but cannot afford the rising housing cost.

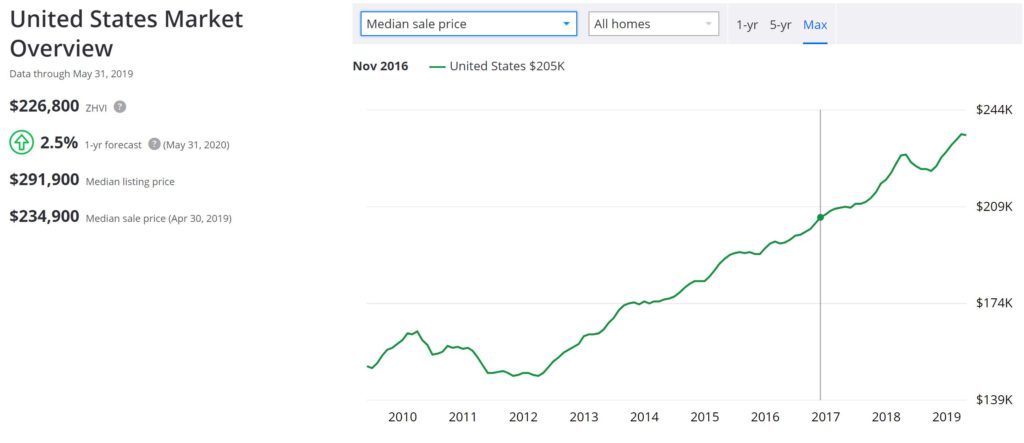

Now workforce housing can be any type of property, such as single family houses or townhouses, however these options are much less affordable now since the national average home price has increased by more than 50% since financial crisis (according to Zillow).

Therefore we narrow it down to multifamily properties such as apartments and manufactured home communities, which still offer affordable housing options to people making 50,000 or less a year.

So why does it make sense to invest in workforce housing?

Here’s why we think it is a STEAL.

1. Stable Cashflow

This is one of the most important reasons to invest in workforce housing. The economics of scale makes it more cost effective to manage a multifamily property compared to single family. Along with the ample availability of cheap financing from Fannie Mae and Freddie Mac, most of properties you look to purchase will have positive cashflow. As a matter of fact, in order to obtain agency financing, the DSCR (Debt Service Coverage Ratio) needs to be at least 1.25. In other words, the available cash after deducting operating expense should be 25% higher than the debt service amount. This ensures most properties will have positive cashflow from day one.

2. Tax benefit

As Uncle Sam usually takes a cut in almost every income you earn, it is important to consider the tax implication on any investment you make. Fortunately, the new tax law passed in 2017 added many benefits to real estate investing, one of which is to allow accelerated deprecation of certain assets in Year 1. This is a game changer for investors as they may not need to pay any tax on their return on their multifamily investments in the first 3-5 years. We will dedicate a separate post specifically for this topic.

3. Equity Growth

One of the advantages of commercial multifamily assets compared to residential properties lies in their valuation methodology. In contrast to single family houses that are valued by comparable sales, multifamily properties are priced by their Net Operating Income (NOI) divided by the market cap rate. We will expand this in another post, but in a nutshell, the value of the property is proportional to the income it generates. Thus it is possible to force the appreciation of the property by executing business plan and increasing revenue, even during market downturn.

4. Asset Diversification

Multifamily assets historically have a low correlation with other financial assets, as real estate is driven by more locale factors (such as job growth, new house starts and inventory in the area). This dispersion of individual assets makes it possible to find deals at any time during the economic cycle. In addition, certain workforce housing assets such as manufactured home communities will actually perform better during recession as more people may downsize and looking for affordable housing, thus driving up the demand of this type of assets

5. Leverage

As mentioned above, it is possible to obtain cheap financing on these properties, which usually covers 70-80% of the total acquisition cost. The beauty of the multifamily investing is that if you participate in a syndication and invest as a passive investor, you can have this 4 to 5X leverage but without worrying about guaranteeing the loan ( There are no credit checks and no recourse against you) I don’t know many investments out there that can give you the best of both worlds like this.

There are many other reasons to invest in multifamily workforce housing, such as increasing demand due to the affordability housing crisis, limited supply and hard assets. We will touch upon these aspects in our future posts.

For now, hopefully the STEAL (Stable cashflow, Tax benefit, Equity growth, Asset diversification and Leverage) factors will be enough to get you interested and look forward to our next article.

All Comments:

Nice!

Well I definitely enjoyed studying it. This subject provided by you is very useful for good planning.