S&P hits all time high again.. It has an amazing run this year with year-to-day return over 21%! Yay!

I don’t know about you, but I use every chance like this as a great selling opportunity. Yes it may continue go up as no one has a crystal ball to say when is the ceiling. However the question is: are there better alternatives out there?

Before we delve into the answer, I would like to clarify what we refer here by stock investing.

We are not discussing trading individual stocks. PERIOD. One of the most important lessons I learned in investing in the past few years is that one needs to have an edge to succeed in investing, whether be informational, physical or financial. For an average Joe, investing in single stock market is like an amateur athlete competing with professional players in Olympic arena. What advantage do you have when you have a nine to five job while on the other side, there is a team of machines and savvy analysts monitoring the market 24/7? You may get a few trades right, but only a very small percentage of people can say they beat the market consistently. For the majority of folks here, low cost index funds or ETFs are the best/only way to go if you want to get consistent results from the stock market .

Now that we establish the base here, let’s talk about why investing in workforce housing is a far superior alternative.

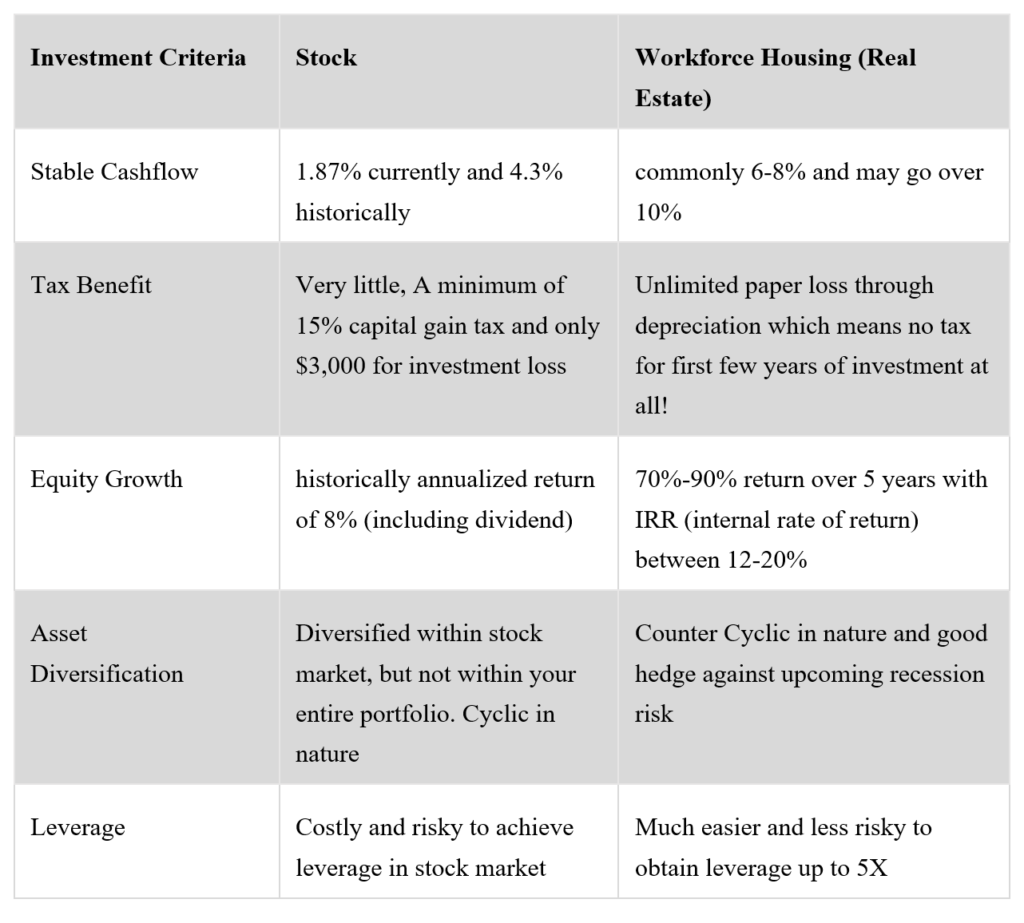

Here we use our proprietary “STEAL” framework to assess the characteristics of any investments. We believe any good investment should check all boxes below:

STABLE CASHFLOW: Average dividend yield of S&P 500 is currently 1.87% and historical average is 4.3%. Conversely, it is quite common to achieve at least 6-8% Cash on Cash return on any investment into the workforce housing sector. If you pick the right project, the annual return can be over 10% as well. How many stocks can offer that kind of dividend?

TAX BENEFIT: There is not much tax benefit of investing in stocks. You will need to pay at least 15% capital gain tax when you make money. But when you lose money, you can only offset a loss of maximum of $3,000. On the other hand, there is really no limit on how much tax you can deduct on real estate transactions, especially with the new tax law. We will discuss tax saving in much detail in a future article.

EQUITY GROWTH: The historical annualized return of S&P 500 is about 8%, which already includes the dividend payout. Inside real estate world, the projected total return is commonly between 70-90% over 5 years with IRR between 12-20%. Not to mention, these are the after tax returns for the first few years as no tax needs to be paid!

ASSET DIVERSIFICATION: You may think S&P 500 is diversified already, after all, it has 500 companies inside, right? If you only think about the stock portfolio, this argument may be correct, however at the asset class level, stock market is highly correlated with the expectation of the economic growth, thus not a good choice when a recession is upcoming. The beauty of workforce housing is that it is counter-cyclic in nature. The worst the economic turns out, the stronger demand for housing with affordable rent. This makes it a good diversification to your portfolio if most of your other assets are in the traditional asset classes like stocks.

LEVERAGE: It is possible to have leverage in stock market but at a very high cost. Many times you need to open a margin account and put sufficient collateral to ensure the account balance stays positive. Some of the biggest failures in stock market are due to this extreme level of leverage and risk. In workforce housing space, it is possible to have a non-recourse loan which gives you 4 to 5 times of leverage. At the same time, banks will not go after you personally if you cannot afford the mortgage payment. Not to mention, there are already cushions built inside these properties where the properties generate sufficient income to pay off the mortgage and the financing can last as long as 7-12 years, thus reducing the leverage risk to minimum.

I would add one more point outside of the above STEAL framework, which is gaining your edge in investments as I mentioned earlier. All real estates are local, which means it is easier to gain an edge in your local area. Even if you go outside your local area, there are proven ways to find the right property at the right location. There are of course competitions in real estate world as well, however, it is far less fierce compared to stock market. If you take the time to learn a little bit about workforce housing, you will find it is far simpler and more predictable compared to stock market.

Listen, I am not here to say that you need to sell all your stock portfolio and invest in workforce housing today. You have to do your homework like on any investments. Getting yourself educated is the best way to gain an edge in investment. And this is what this letter is supposed to do.

Stay tuned for our future educational articles!